Maximize Your Purchasing Power with a Jumbo Loan for High-End Houses

Maximize Your Purchasing Power with a Jumbo Loan for High-End Houses

Blog Article

The Impact of Jumbo Finances on Your Funding Options: What You Need to Know Prior To Applying

Jumbo fundings can play a crucial function in shaping your financing alternatives, particularly when it comes to obtaining high-value residential properties. While they offer the opportunity for bigger loan amounts without the problem of personal home loan insurance policy (PMI), they also feature rigorous qualification criteria that require careful consideration. Recognizing the equilibrium between the benefits and obstacles positioned by these car loans is necessary for prospective debtors. As you evaluate your options, the implications of rates of interest and product accessibility might trigger you to reassess your monetary method relocating ahead (jumbo loan).

Recognizing Jumbo Finances

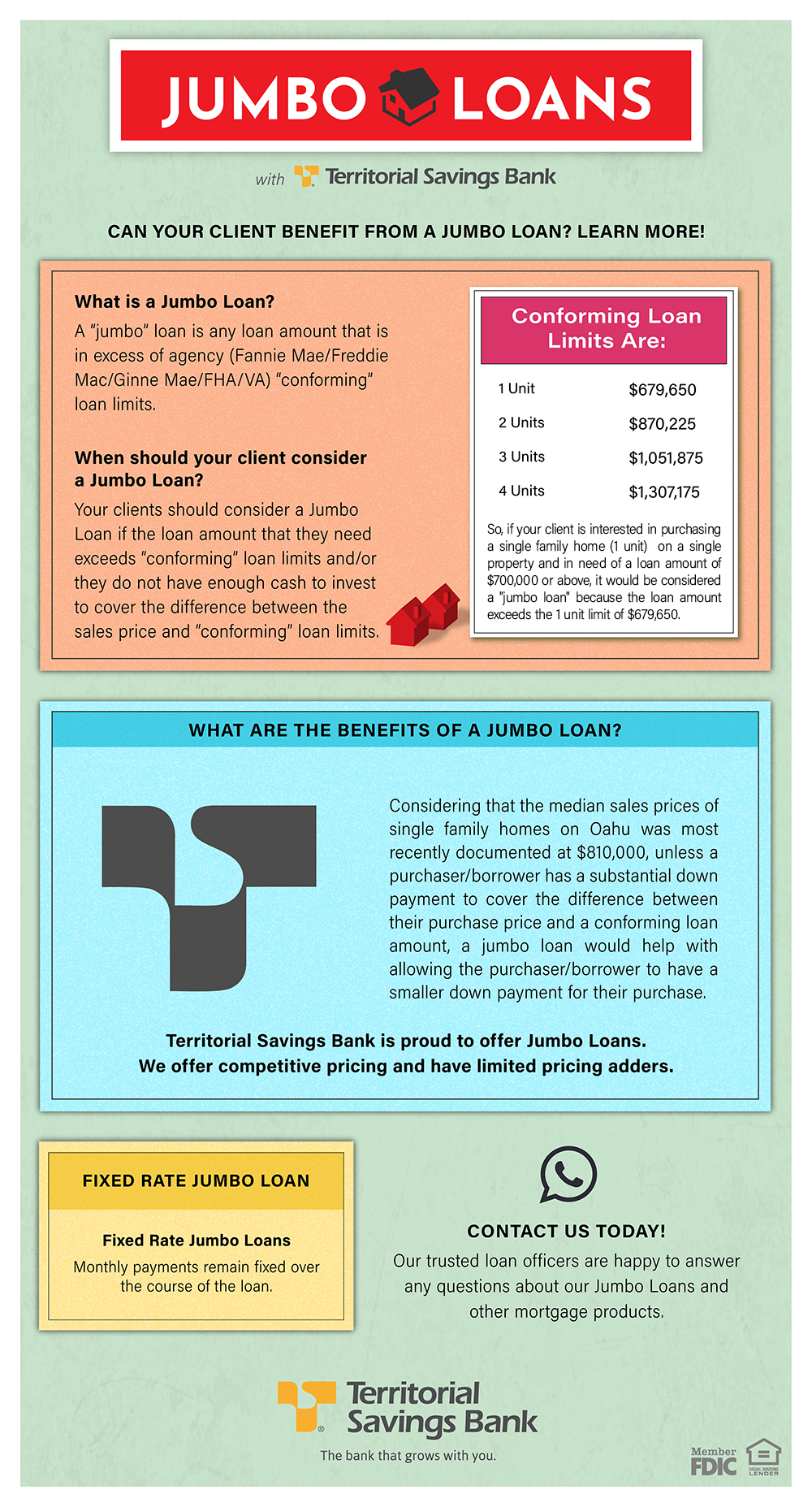

Comprehending Jumbo Loans requires a clear grasp of their special features and demands. Jumbo car loans are a kind of home loan that exceeds the adapting lending limitations established by the Federal Housing Money Firm (FHFA) These limitations differ by location but generally cap at $647,200 in many areas, making big fundings necessary for financing higher-priced residential or commercial properties.

One of the defining features of jumbo car loans is that they are not qualified for acquisition by Fannie Mae or Freddie Mac, which causes stricter underwriting standards. Borrowers need to frequently demonstrate a higher credit rating, usually over 700, and give considerable documents of revenue and assets. Furthermore, lending institutions may require a larger down payment-- typically 20% or more-- to reduce danger.

Rate of interest on jumbo lendings can be somewhat more than those for adhering financings because of the increased risk presumed by the loan provider. Nevertheless, the absence of private mortgage insurance policy (PMI) can counter some of these costs. Understanding these elements is important for possible borrowers, as they significantly influence the terms and usefulness of safeguarding a big financing in today's competitive property market.

Advantages of Jumbo Loans

Jumbo loans supply unique advantages for homebuyers seeking to buy high-value residential or commercial properties that surpass standard funding limits. Among the key benefits of jumbo loans is their capacity to finance bigger amounts, permitting customers to acquire homes in premium markets without the constraints imposed by conforming lending restrictions - jumbo loan. This adaptability allows buyers to view a more comprehensive variety of homes that might much better match their needs and preferences

Additionally, jumbo fundings frequently come with competitive rate of interest prices, especially for consumers with strong credit report profiles. This can bring about considerable financial savings over the life of the car loan, making homeownership a lot more budget friendly in the future. Moreover, big car loans can be customized to match specific monetary circumstances, providing different terms and amortization choices that line up with the borrower's goals.

Obstacles of Jumbo Finances

Browsing the intricacies of big financings presents several challenges that possible debtors should be aware of prior to continuing. Unlike adjusting lendings, jumbo financings are not backed by government-sponsored ventures, leading loan providers to take on more extensive standards.

Furthermore, jumbo finances normally include higher interest prices compared to standard finances. This elevated price can considerably impact monthly repayments and overall cost, making it crucial for borrowers to carefully examine their economic situation. The down repayment needs for big financings can be substantial, often varying from 10% to 20% or even more, which can be a barrier for many possible homeowners.

An additional obstacle depends on the limited accessibility of big finance products, as not all lending institutions use them. This can result in a reduced pool of choices, making it crucial for consumers to carry out extensive research and potentially look for specialized loan providers. Generally, comprehending these obstacles is crucial for anyone taking into consideration a jumbo car loan, as it makes certain enlightened decision-making and far better economic planning.

Certification Criteria

For those taking into consideration a jumbo funding, satisfying the credentials requirements is an important step in the application procedure. Unlike traditional lendings, jumbo lendings are not backed by government companies, leading to more stringent demands.

To start with, a strong credit rating is vital; most loan providers require a minimum score of 700. A greater score not just enhances your opportunities of approval yet may additionally protect much better rates of interest. Additionally, customers are typically anticipated to show a considerable income to guarantee they can conveniently take care of greater monthly payments. A debt-to-income (DTI) ratio below 43% is normally favored, with lower proportions being much more positive.

Deposit demands for big fundings are likewise considerable. Consumers should prepare for taking down a minimum of 20% of the building's purchase cost, although some lenders might supply choices as reduced as 10%. Showing cash reserves is important; lenders often need evidence of adequate fluid properties to cover numerous months' worth of home mortgage settlements.

Comparing Funding Choices

When assessing financing alternatives for high-value residential properties, recognizing the differences in between various funding kinds is important. Jumbo loans, which go beyond home adapting financing limitations, typically included more stringent certifications and higher rate of interest than conventional fundings. These lendings are not backed by government-sponsored ventures, which raises the loan provider's risk and can bring about much more strict underwriting criteria.

On the other hand, standard financings offer more versatility and are often less complicated to obtain for consumers with strong credit accounts. They might come with reduced rate of interest and a larger variety of options, such as fixed or adjustable-rate home loans. Additionally, government-backed financings, like FHA or VA finances, provide possibilities for lower down settlements and even more tolerant credit score needs, though they additionally impose restrictions on the loan quantities.

Verdict

Finally, big car loans present both chances and challenges for possible property buyers looking for funding for high-value residential or commercial properties. While these finances allow for larger amounts without the problem of exclusive home loan insurance policy, they come with rigorous qualification needs and potential downsides such as higher rate of interest. A detailed understanding of the advantages and challenges connected with jumbo lendings is important for making informed choices that align with long-term financial objectives and purposes in read here the genuine estate market.

Report this page